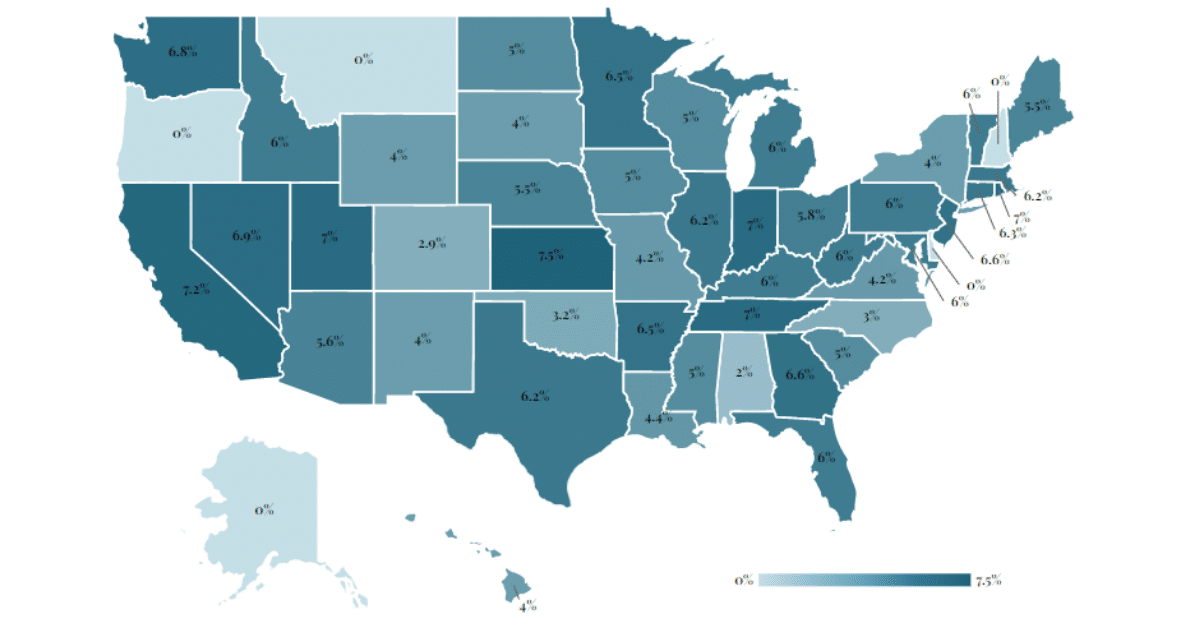

Save time and money with our concise, state-by-state vehicle sales tax reciprocity chart. This chart clearly outlines which states offer reciprocity, allowing you to avoid paying double taxes when purchasing a vehicle out of state. We’ve compiled this data to provide accurate and readily available information.

Understanding sales tax reciprocity is critical before buying a vehicle across state lines. Our chart focuses on practical application, showing you which states have agreements and which don’t. This allows you to make informed decisions and plan your purchase accordingly, ensuring a smooth transaction.

Key features of this chart include a simple format, clear identification of reciprocal states, and links to relevant state DMV websites for detailed regulations. We regularly update this resource to reflect current legislation, ensuring the information remains current and useful. Use this chart as your primary reference point before buying a car across state lines.

- Understanding Vehicle Sales Tax Reciprocity: A State-by-State Guide

- Navigating Sales Tax Exemptions Based on Residency: What You Need to Know

- Active Military Personnel and Veterans

- Full-Time Students

- Temporary Residents

- Using a Vehicle Sales Tax Reciprocity Chart: A Practical Walkthrough

- Understanding the Chart’s Information

- Gathering Necessary Information

- Example Scenario

- Important Note

- Where to Find Charts

- Interpreting the Chart and Applying it to Your Situation: Step-by-Step Instructions

Understanding Vehicle Sales Tax Reciprocity: A State-by-State Guide

Check your state’s Department of Motor Vehicles (DMV) website for the most accurate and up-to-date information. This guide provides a general overview, but specific rules vary.

Arizona: Arizona generally doesn’t reciprocate vehicle sales taxes with other states. Residents should expect to pay Arizona sales tax on vehicle purchases, regardless of where the vehicle was bought.

California: California doesn’t have reciprocal agreements for vehicle sales tax. Expect to pay California sales tax on vehicles purchased within the state, and you might owe use tax if you bring a vehicle purchased elsewhere into the state.

Florida: Florida’s sales tax rules are complex. While no blanket reciprocity exists, certain situations may allow for exemptions. Consult the Florida Department of Revenue for specifics.

Illinois: Illinois does not have widespread sales tax reciprocity for vehicles. You’ll likely pay Illinois sales tax on any vehicle purchased and registered within the state.

New York: New York generally doesn’t offer sales tax reciprocity on vehicles. Expect to pay New York sales tax when registering a vehicle purchased in-state or out-of-state.

Texas: Texas typically doesn’t reciprocate vehicle sales taxes. Regardless of purchase location, you’ll likely owe Texas sales tax upon registration.

Disclaimer: This information is for general guidance only and doesn’t constitute legal or tax advice. Always verify details with your state’s DMV and revenue agencies before making any vehicle purchases.

Further Research: For a complete understanding of vehicle sales tax reciprocity, explore the individual DMV websites of states relevant to your situation. You’ll find specific rules and exceptions clearly outlined.

Navigating Sales Tax Exemptions Based on Residency: What You Need to Know

Confirm your residency status with official documentation. This usually means providing a driver’s license and proof of address. Discrepancies can delay or even void exemptions.

Active Military Personnel and Veterans

Military personnel often qualify for exemptions in multiple states. Check the specific requirements for each state’s Department of Motor Vehicles (DMV). Veteran status might offer additional tax breaks; verify eligibility using your DD-214 form.

Full-Time Students

Many states grant sales tax exemptions to full-time students. You’ll likely need proof of enrollment from your educational institution. Keep your student ID handy, and understand the specific residency guidelines applicable to students.

Temporary Residents

If you’re a temporary resident (e.g., working on a short-term contract), understand the state’s rules on temporary residency and sales tax. Some states offer exemptions for temporary residents under specific circumstances; consult state guidelines or tax professionals for clarifications. Duration of stay is a critical factor.

Remember: State laws change. Regularly review your state’s DMV website for the most updated information on sales tax exemptions and required documentation.

Using a Vehicle Sales Tax Reciprocity Chart: A Practical Walkthrough

First, locate your state on the chart. Then, find the column representing your intended purchase state. The intersecting cell shows the sales tax rules.

Understanding the Chart’s Information

Charts usually indicate whether your home state offers reciprocity (no additional tax), requires you to pay the purchasing state’s tax only, or requires you to pay both states’ taxes. Pay close attention to any footnotes. They may contain important details like specific vehicle types or exceptions.

- Reciprocity: You’ll only pay sales tax in the state where you bought the vehicle.

- No Reciprocity, Pay Purchasing State Tax Only: You’ll only pay sales tax to the state where you purchased the vehicle.

- No Reciprocity, Pay Both States’ Taxes: You’ll owe sales tax to both your home state and the state of purchase. Check if one state offers a credit for taxes paid to the other.

Gathering Necessary Information

- Your State of Residence: This is crucial for cross-referencing on the chart.

- Vehicle Purchase Location: This will be the other axis point in your chart search.

- Vehicle Purchase Price: This determines the actual tax amount.

After identifying the tax rules, carefully calculate the amount due using the applicable tax rate for each state. Keep all documentation, including the reciprocity chart, purchase agreement, and tax receipts.

Example Scenario

Suppose you live in Oregon and buy a car in California. The chart shows Oregon and California have a reciprocity agreement. This means you only pay California’s sales tax.

Important Note

Tax laws change. Always verify information with official state revenue departments before making a purchase. Tax laws can be complicated, seek professional tax advice if necessary.

Where to Find Charts

Reliable sources include state Department of Revenue websites and reputable automotive websites offering information on vehicle purchases.

Interpreting the Chart and Applying it to Your Situation: Step-by-Step Instructions

First, locate your state of residence on the chart’s vertical axis. Next, find the state where you purchased the vehicle on the horizontal axis. The intersecting cell displays the tax reciprocity rules.

Look for keywords: “Full Reciprocity” means you pay your home state’s tax only. “No Reciprocity” means you pay the purchase state’s tax. “Partial Reciprocity” requires careful examination; it often means a credit for taxes already paid, potentially reducing the overall tax burden. Study any accompanying notes or explanations within the cell.

Example: If you live in California and bought a car in Nevada, and the chart shows “Full Reciprocity,” you only pay California’s vehicle sales tax. However, if it shows “Partial Reciprocity,” you need to consult the DMV websites of both states to determine the specific calculation.

Check for exceptions: Some charts highlight special cases, like certain vehicle types or purchase situations. Pay close attention to these caveats, as they might significantly alter your tax liability.

Verify details: Always double-check the information on your state’s Department of Motor Vehicles (DMV) website to confirm the tax regulations. The chart is a helpful guide, but the official source is your state’s DMV.

Actionable Advice: Gather your purchase paperwork, including the sales contract and title. Armed with this information and the chart’s data, contact your state’s DMV for clarification or to complete the registration process correctly.

Consult a tax professional: For complex scenarios or substantial tax implications, consulting a qualified tax professional is advisable. They can provide personalized guidance based on your specific circumstances.