Consider Medicare Part D plans if you’re eligible. Many offer surprisingly affordable prescription drug coverage, especially with the help of Medicare subsidies. Check your eligibility and compare plans based on your specific medications and pharmacy preferences; you might find a plan costing under $10 per month.

For those without Medicare, explore state-sponsored programs and Medicaid. Income-based assistance can drastically reduce prescription costs, potentially covering almost all expenses. Eligibility criteria vary by state, so investigate your local options immediately. The application process can be straightforward, often completed online.

Don’t overlook employer-sponsored insurance. Many employers offer prescription drug coverage as part of a comprehensive benefits package. Review your company’s plan details carefully; even seemingly expensive plans might offer significant discounts for preferred pharmacies or generic medications. Opting for a mail-order pharmacy frequently yields substantial savings.

Finally, independent insurance plans offer varying levels of coverage and costs. Use online comparison tools to assess various providers and customize your coverage based on your unique needs and budget. Factors like deductibles and co-pays directly influence your out-of-pocket expenses; carefully analyze these before committing to a plan.

- Finding the Cheapest Prescription Drug Insurance: A Practical Guide

- Negotiate Drug Prices

- Explore Employer-Sponsored Plans

- Understand Formularies

- Check for Manufacturer Coupons

- Consider Mail-Order Pharmacies

- Government Assistance Programs

- Generic Alternatives

- Understanding Your Options: Medicare, Medicaid, and Marketplace Plans

- Medicare Prescription Drug Coverage (Part D)

- Medicaid Prescription Drug Benefits

- Marketplace Plans: Affordable Care Act (ACA)

- Strategies for Minimizing Prescription Drug Costs

- Explore Patient Assistance Programs

- Utilize Prescription Drug Coupons and Discount Cards

- Consider Generic Alternatives

- Check for Mail-Order Options

- Ask your Doctor about Drug Samples

- Think About Medication Dosage and Frequency

Finding the Cheapest Prescription Drug Insurance: A Practical Guide

Compare plans directly through your state’s insurance marketplace. Many states offer online portals simplifying this process. Check eligibility requirements and compare premiums, deductibles, and co-pays across different plans.

Negotiate Drug Prices

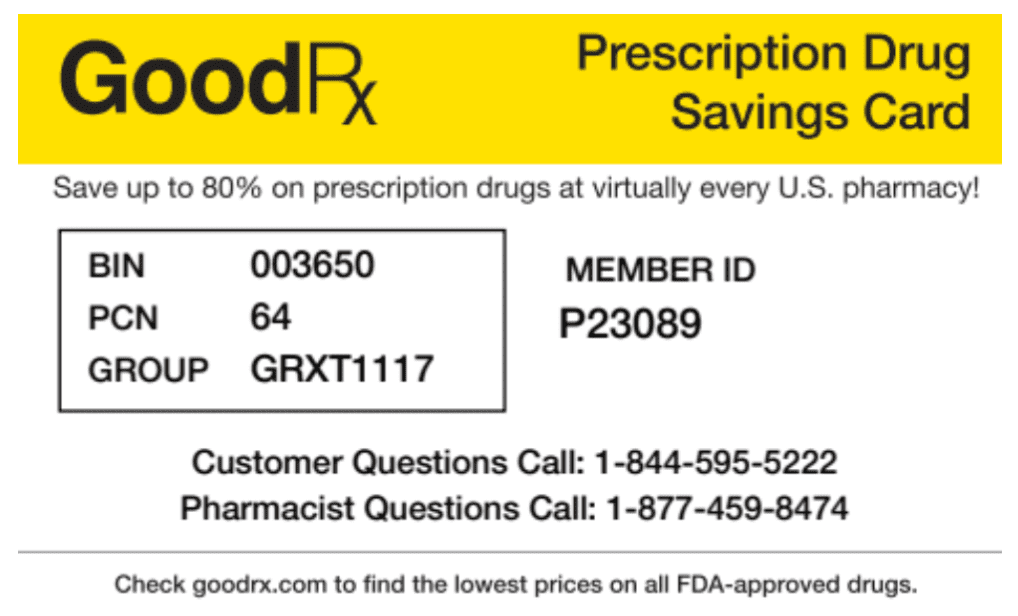

Don’t hesitate to negotiate! Pharmacies sometimes offer discounts, especially for cash payers or those without insurance. Ask about their patient assistance programs or discounts for seniors or those with chronic conditions. Consider using a prescription discount card; many are free.

Explore Employer-Sponsored Plans

Review your employer’s health insurance options. Many companies offer prescription drug coverage as part of their benefits package. Carefully compare plans’ formularies to ensure your needed medications are covered at a reasonable cost. Consider the plan’s tier system – lower tiers usually mean lower costs.

Understand Formularies

Familiarize yourself with each plan’s formulary – a list of covered medications and their associated cost tiers. A medication’s placement on the formulary significantly influences your out-of-pocket expenses. If your medication isn’t covered, explore alternatives with your doctor.

Check for Manufacturer Coupons

Pharmaceutical companies often provide coupons or savings cards to reduce the cost of their medications. These can significantly impact your total cost, even with insurance. Search the manufacturer’s website or your pharmacy’s website for available savings programs.

Consider Mail-Order Pharmacies

For regularly prescribed medications, mail-order pharmacies often offer lower prices than local pharmacies. This is particularly beneficial for those taking multiple medications or those with chronic conditions. Compare prices directly between mail-order and local options.

Government Assistance Programs

Medicare Part D and Medicaid provide prescription drug coverage for eligible individuals. Eligibility requirements vary; investigate these programs if you qualify. There are often income limits and other factors affecting eligibility.

Generic Alternatives

Generic drugs are often significantly cheaper than brand-name medications while having the same active ingredients. Discuss generic options with your doctor; they are usually just as effective and can save you considerable money.

Understanding Your Options: Medicare, Medicaid, and Marketplace Plans

Determine your eligibility for Medicare or Medicaid first. Medicare covers individuals 65 and older or those with certain disabilities. Medicaid provides coverage based on income and household size; eligibility varies by state. Check your state’s Medicaid website for specifics. If you’re not eligible for either, explore the Health Insurance Marketplace.

Medicare Prescription Drug Coverage (Part D)

Medicare Part D is a separate prescription drug plan you must enroll in. Premiums and cost-sharing vary depending on the plan you choose. Consider the formulary (list of covered drugs) carefully, ensuring your medications are included. The Medicare Plan Finder website helps you compare plans.

Medicaid Prescription Drug Benefits

Medicaid prescription drug coverage is included in your plan. Specific covered medications and cost-sharing vary by state. Contact your state Medicaid agency to understand your benefits. They can help you find affordable options.

Marketplace Plans: Affordable Care Act (ACA)

Marketplace plans, offered through the ACA, provide subsidized insurance based on income. Many offer prescription drug coverage. Use the Healthcare.gov website to compare plans, considering your monthly premiums, deductibles, and copays. Subsidies can significantly reduce the cost of premiums. Remember to factor in the cost of your prescriptions when choosing a plan.

Strategies for Minimizing Prescription Drug Costs

Negotiate directly with your pharmacy. Many pharmacies offer discounts if you pay cash. Compare prices at different pharmacies, including those in neighboring towns or states. Utilize online pharmacy comparison tools for easier price checking.

Explore Patient Assistance Programs

Many pharmaceutical companies offer patient assistance programs (PAPs) that provide free or reduced-cost medications to eligible individuals. Check the manufacturer’s website for details or use a PAP search engine. Look into programs sponsored by non-profit organizations; they frequently provide assistance based on income and other factors.

Utilize Prescription Drug Coupons and Discount Cards

Several websites and apps provide coupons and discount cards for prescription drugs. These cards can significantly lower your out-of-pocket expenses. Remember to compare multiple cards and coupons before choosing one, as discounts vary.

Consider Generic Alternatives

Generic medications are typically much cheaper than brand-name drugs while offering the same active ingredients. Ask your doctor if a generic option is available for your prescription.

Check for Mail-Order Options

Mail-order pharmacies sometimes offer lower prices on prescription medications, particularly for long-term treatments. Compare their prices to local pharmacies before committing.

Ask your Doctor about Drug Samples

Your doctor might have samples of your prescription available. This can help bridge gaps between refills or provide a cost-effective option for trying a new medication.

Think About Medication Dosage and Frequency

Discuss with your doctor if a lower dosage or less frequent administration could be effective while minimizing the overall cost. This is especially relevant for long-term medications.